The Mission

Finishing a 90-Year

Investigation

The Oversight

In 1931, the discovery of gold nuggets in the Souris River Valley sparked a brief, frantic rush. But the geology of North Dakota proved to be a formidable gatekeeper: the gold was too deep, too fine, and trapped in water-saturated sediments that bankrupted every conventional mining operation of the era. By 1935, federal investigations by the FERA and USGS were halted, leaving the state's most promising mineral corridors documented but untouched.

A Convergence of Expertise

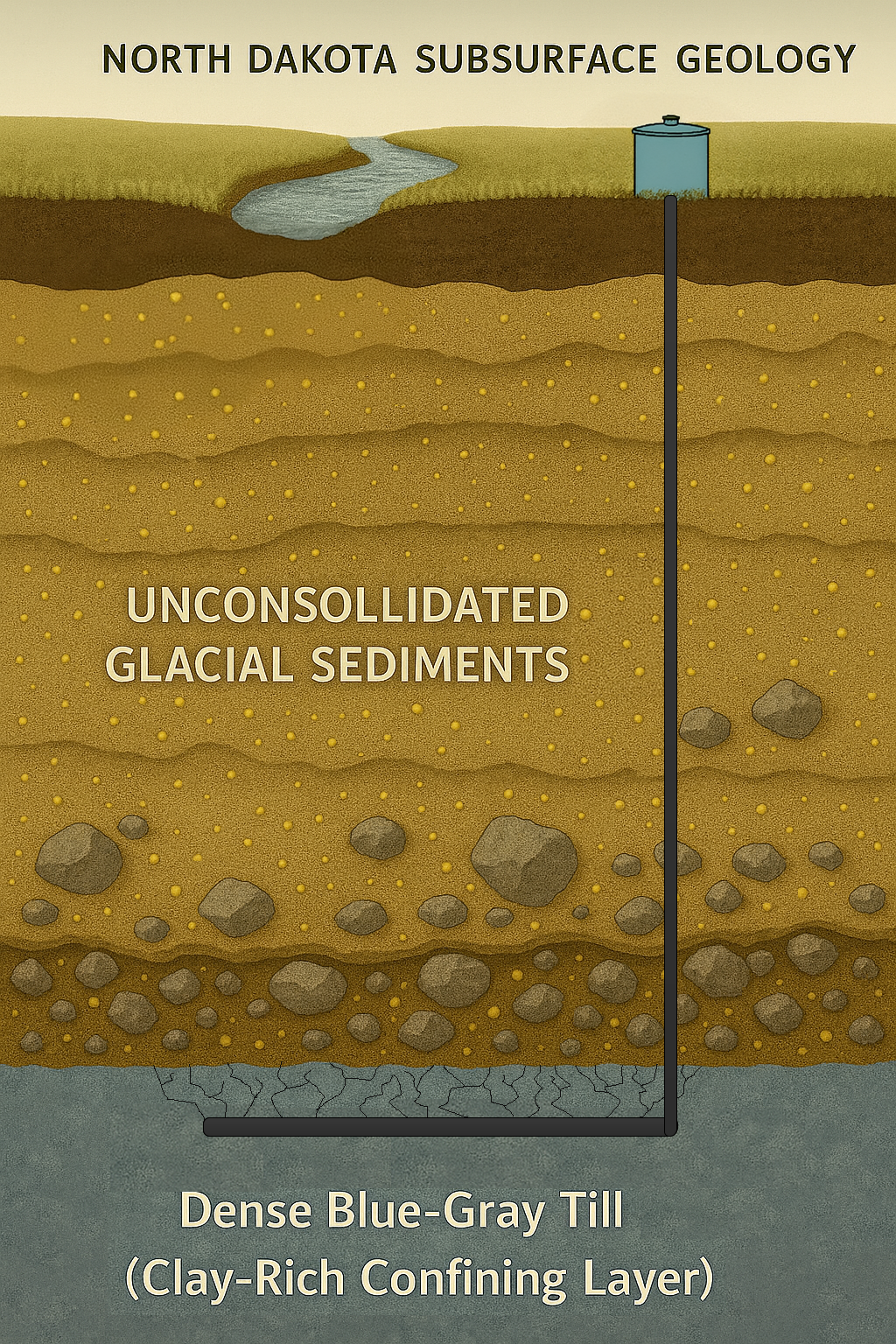

Lost Horizon Inc. was founded to finish that investigation. By applying advanced hydraulic and drilling methodologies perfected in the Bakken oil fields to the specific challenges of deep glacial placers, we have bridged the gap between historical geological data and modern extraction capability. We don't see the 80-foot overburden as a barrier. We see it as a pressurized environment where our proprietary technology thrives.

Proven in the Field

Our thesis is supported by more than archives. In the heart of the gold-bearing valley in Carpio, ND, modern surface sampling has identified over 70 gold-bearing specimens and quartz vein material consistent with Canadian Shield origin. The glacial transport system is no longer a geological theory. It is a massive, untapped resource finally within reach.